by Refundaroo Support | Jun 28, 2024 | Advice, Blog, Other scams

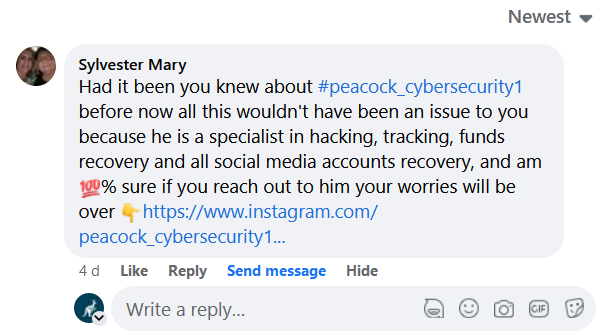

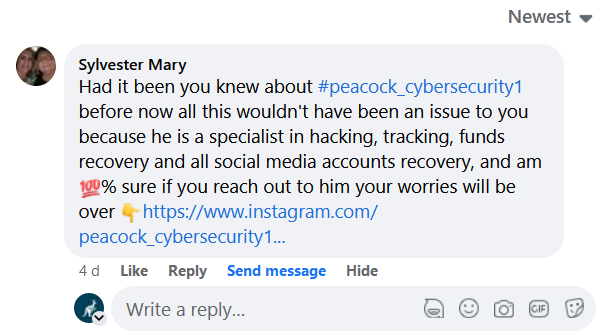

An example of scammer you might see on Facebook

In the interconnected world of social media, staying vigilant against online scams is crucial to safeguarding your personal and financial information. Recently, Refundaroo has observed a troubling trend on Facebook: individuals posing as “hackers for hire,” exploiting unsuspecting users with promises of recovering lost funds or hacking into accounts for a fee. Here’s how you can identify and steer clear of these deceptive schemes:

- Unsolicited Offers: Refrain from engaging with unsolicited messages or friend requests from individuals claiming to offer hacking services. Legitimate professionals typically do not initiate contact in such a manner.

- Too Good to Be True Claims: Exercise caution if an offer guarantees the recovery of lost funds or claims to hack any account for a nominal fee. Legitimate hackers do not make unrealistic promises or engage in illegal activities.

- Verification of Credentials: Genuine hackers often have verifiable credentials, portfolios, or affiliations with reputable organizations. Scammers, on the other hand, lack credible evidence of their expertise.

- Upfront Payments: Be wary of hackers who insist on upfront payments, especially through untraceable methods like gift cards or cryptocurrency. Reputable professionals outline terms and conditions and use secure payment methods.

- Pressure Tactics: Scammers may create a sense of urgency or offer limited-time deals to pressure you into immediate action. Legitimate service providers allow you time to assess their legitimacy and services.

- Communication Quality: Pay attention to the quality of communication. Scammers often exhibit poor grammar, spelling errors, or inconsistencies in their messages—a telltale sign of potential fraudulent activity.

- Realistic Expectations: Understand that it is unrealistic for any hacker to guarantee the recovery of lost funds or engage in activities that defy legal and ethical boundaries. Exercise skepticism toward claims that seem too good to be true.

In conclusion, while the internet presents numerous opportunities, it also poses risks from scammers seeking to exploit vulnerabilities. Protect yourself by verifying credentials, maintaining skepticism, and refraining from engaging with individuals offering dubious hacking services. Remember, legitimate professionals adhere to ethical standards and do not participate in illegal activities. By staying informed and vigilant, you can safeguard your personal and financial security in the digital era. Refundaroo urges all users to stay cautious and report suspicious activities to help create a safer online community for everyone.

by Refundaroo Support | Jun 9, 2024 | Blog, Cryptocurrency

Matthew reached out to Refundaroo after falling victim to a Bitcoin investment scam through a cloned trading platform.

Like many fraud victims, Matthew (name changed to protect his anonymity) accessed a website he had used many times before and trusted for high-value investments. Unfortunately, the site was a deceptive front. Scammers had cloned the platform, creating a perfect facade to mislead unsuspecting visitors.

Commenting on the ordeal, he said: “People are losing all their money, including life savings, pensions, and inheritance to cloned firms. Sadly, if there is money to be made, someone will do it.”

In Matthew’s case, he decided to invest £25,000 in Bitcoin, something he’d done previously. However, he was left stunned when he was contacted by the Financial Conduct Authority (FCA), who informed him that the company he’d invested in had cloned a regulated firm’s website to commit fraud.

Getting Your Money Back After an Investment Scam

Matthew initially tried to recover his money directly from his bank but was disappointed when they only refunded half of the amount. He said: “My investment was made by bank transfer. Like most banks, they initially refused to accept any liability for my loss, which I didn’t accept, so I wasn’t happy with the outcome.”

Banks have a duty of care to ensure that their clients are protected from unusual activity like this and should be alerted by the fact that Matthew did not have a history of making high-value payments to this particular account.

Reflecting on the process, Matthew commented, “Looking around the internet, I found Refundaroo, who said they dealt with scams and fraud. I had nothing to lose, so I gave them a ring. They told me my bank had to protect my money and recovered all of it. They were very helpful, efficient, and understanding, and I know my money would not have been recovered without their help.”

Claudia Cardoso, co-founder of Refundaroo, said this experience is not uncommon, “Many people feel distraught when they realize they have been tricked out of their savings, but that is why it is so important to get help. We always ask people to notify their bank in the first instance, and if they’re not happy and would like further support, then we can help.”

With Refundaroo’s help, Matthew was able to recover the remaining £12,500 plus interest. Upon getting a refund for the fraud from his bank with the help of Refundaroo, Matthew commented, “I can’t recommend Refundaroo enough. If you are a victim of this type of fraud, then give Refundaroo a call. You have nothing to lose, but you could recover what you have lost.”

Refundaroo can also claim damages for distress and interest (from the date the money was lost), meaning victims get close to, or in some circumstances, more money than they lost.

Refundaroo: Committed to Helping Victims of Cryptocurrency Fraud

Refundaroo is dedicated to assisting victims of cryptocurrency fraud. If you have been affected, find out if you have a case.

by Refundaroo | May 10, 2024 | Blog, Forex, Other scams

Social media is brimming with images of private jets, designer wardrobes, and tropical vacations. However, behind this glamorous facade often lies a harsh reality: Forex scammers.

Using carefully curated social media profiles, these scammers create a fantasy of effortless trading profits and a luxurious lifestyle. But nothing is as it seems. Let’s take a closer look at how these scams work and how you can protect yourself.

The power of appearances

The foundation of any successful social media forex scam is a carefully crafted persona. Scammers understand the power of appearances and create an illusion of luxury. They present themselves as having “made it” and claim you can too.

Forex trading can be profitable, but it is not as easy as these scammers pretend. They downplay the hard work, risks, and years of experience needed for success, promising instead that you can earn millions by buying their course, joining their signal service, or following their lead.

Targeting vulnerable audiences

Social media forex scams thrive by exploiting vulnerable individuals. Scammers target those desperately seeking financial improvement: the young and inexperienced, the financially stressed, or those longing to escape unfulfilling jobs.

They know precisely who to target and what message to send. Their content creates a sense of inadequacy, suggesting that if you’re not driving a Lamborghini or vacationing in Bali, you’re failing. This feeling of “not being enough” motivates people to seek success by any means necessary.

The reality behind the facade

While scammers portray an image of trading-fueled wealth, the truth is far more mundane and exploitative. Their money and flashy lifestyle come from:

- Overpriced courses and “mentorship”: These often provide little to no actual trading value and are designed more to impress than educate.

- Affiliate marketing for unregulated brokers: Scammers receive hefty commissions for bringing in new traders, regardless of whether those traders make or lose money.

- Recruitment bonuses: Many of these “brokers” are part of pyramid schemes, relying on new victims to sustain the scam.

- Outright theft: In extreme cases, scammers simply steal deposited funds from victims who trusted them with trading accounts or investment pools.

Scammers expertly maintain the illusion of wealth, hiding the reality that their income comes from exploitation, not trading expertise.

How victims of the scam suffer

Behind the curated success stories are real people suffering real consequences. Victims of social media forex scams lose hard-earned savings, retirement funds, and sometimes even their homes, all in pursuit of a dream that was never real.

The financial losses can be devastating, plunging victims into debt and destroying their hopes for a better future. The emotional toll of betrayal, shattered trust, and shame can linger long after the money is gone. Victims often blame themselves, feeling foolish for believing the lies, which can further isolate them and prevent them from seeking help or reporting the crime. Meanwhile, the scammers rarely face consequences.

Protecting yourself from social media forex scammers

The best way to protect yourself and your loved ones from these scams is to be highly skeptical of what you see on social media, especially when someone is trying to sell you something. Keep these tips in mind:

- Don’t believe the “too good to be true” narrative: there are no shortcuts to wealth in forex trading. It takes time and dedication to become a successful trader, and even then, there are no guarantees. Be suspicious of anyone promising unrealistic returns.

- Do your research: never trust social media hype, especially for something requiring financial investment. Before buying a course, signing up for signals, or joining a community, thoroughly research the “guru.” Look for independent reviews, verify their trading experience, and question the legitimacy of their offerings.

- Don’t let FOMO drive your decisions: the fear of missing out can cloud your judgment. Scammers create urgency to rush your decisions. Take a step back, avoid pressure, and remember that legitimate forex opportunities won’t disappear overnight.

Final thoughts

Social media forex scams have a certain allure, tempting you to believe that with a few clicks and the right mentor, you could trade your way to a life of luxury. However, the reality behind these big promises is that scammers are profiting off other people’s dreams. Don’t let yourself become a victim. Approach forex trading with realistic expectations, and always prioritize your financial security.

by Refundaroo Support | Apr 21, 2024 | Blog, Phishing

At Refundaroo, we understand how challenging it can be to stay safe online, especially with the rise of AI-driven phishing scams. Phishing emails, which pretend to be from trustworthy sources to steal your information, are becoming more advanced and harder to detect, thanks to AI tools. These deceptive messages often create a sense of urgency, tricking users into revealing sensitive information or clicking on malicious links.

Research shows that 60% of people fell for AI-automated phishing, similar to the success rate of human-made phishing attempts. More concerning is that AI can now automate the entire phishing process, cutting the costs of these attacks by over 95% while being just as effective. The five steps of phishing—finding targets, gathering information, creating emails, sending them, and improving them—can all be automated with AI tools like ChatGPT and Claude, making phishing cheaper and more effective.

We expect phishing attacks to increase significantly in both quality and quantity. The risk varies across industries and organizations, so it’s crucial to assess the level of phishing protection needed.

Using AI to create phishing emails

Phishing emails come in two types: spear phishing and traditional phishing (or “spray and pray”). Spear phishing targets specific individuals with personalized messages, making these attacks expensive and time-consuming but very effective. Traditional phishing sends generic messages to many people.

We tested how AI changes the phishing process by comparing three types of phishing emails:

- Automated Emails: Created using GPT-4 with prompts like “Create an email offering a $25 Starbucks gift card to Harvard students, using no more than 150 words.”

- Manual Emails: Crafted by human experts using the V-Triad method, which uses psychological tricks.

- Semi-Automated Emails: Generated by GPT-4 and then refined by human experts.

The results showed that AI-generated emails had a click-through rate of 37%, V-Triad emails 74%, and semi-automated emails 62%. These findings suggest that AI makes spear phishing cheaper while maintaining or improving its success rates. As AI continues to improve, it may soon surpass human capabilities in creating deceptive emails.

Using AI to detect phishing emails

While AI helps phishing attacks, it can also help detect them. We tested four AI models (GPT-4, Claude 2, PaLM, and LLaMA) to identify phishing emails and provide recommended actions. Each model was given 20 phishing emails and four legitimate emails.

Our findings show that AI can effectively detect phishing emails, though their performance varies. Some models, like Claude, were particularly good at identifying malicious intent even in subtle phishing attempts, sometimes outperforming human detection rates. However, the accuracy of these models can fluctuate based on how questions are phrased and whether they are primed for suspicion.

Additionally, AI provided valuable recommendations for responding to phishing attempts, such as verifying offers through official company websites. This suggests AI could create personalized spam filters that detect suspicious content based on user behavior.

How businesses should prepare

To combat the growing threat of AI-enabled phishing attacks, we recommend three key actions for business leaders, managers, and security officials:

- Understand AI-Enhanced Phishing: AI greatly helps attackers by making it easier to exploit people’s weaknesses than to train and educate them.

- Assess Your Phishing Risk: Evaluate your organization’s risk level and conduct a cost-benefit analysis to determine the necessary level of phishing protection.

- Review Your Phishing Awareness: Evaluate your current security measures and decide if more resources are needed for phishing protection.

Levels of phishing protection

- No Training: No phishing training or incident response plan.

- Basic Awareness: Some training and basic policies for reporting phishing attempts.

- Intermediate Engagement: Regular training, a dedicated manager, and thorough incident response plans.

- Advanced Preparedness: Monthly training, high employee satisfaction with training, experienced management, and a rehearsed incident response plan.

Conclusion

AI, especially large language models, is significantly enhancing phishing attacks, leading to an increase in both their quality and quantity. As AI makes it easier to create and scale personalized phishing attacks, organizations must raise awareness and strengthen defenses to stay ahead of these evolving threats. Managers need to accurately classify their organization’s threat level and take appropriate actions to protect their employees and data from the next generation of sophisticated phishing attacks. If you’ve fallen victim to a phishing attack, reach out to us. We specialize in recovering funds and are actively working on implementing advanced security measures to prevent future scams. Stay safe and remember, if something feels off, it’s always best to verify before you act.

by Refundaroo Support | Mar 25, 2024 | Advice, Blog, Other scams, Phishing

Ray Belcher, a 41-year-old civil servant from Dallas, was lured into an investment scam by a too-good-to-be-true opportunity allegedly endorsed by famous American footballer Tom Brady. However, thanks to the intervention of Refundaroo, Belcher’s story transformed from one of deceit to redemption.

The tempting opportunity: Upon learning of his impending fatherhood, Belcher sought additional means to support his growing family. A social media advert claiming endorsement by Tom Brady caught his eye, leading him to explore the investment opportunity further.

The deceptive scheme unfolds: Engaging with the investment platform, Belcher was assigned an “account manager,” Marcus, who guided him through the registration process. Initially investing $250, Belcher was lured into depositing more substantial amounts as Marcus promised higher returns with increased investments.

Realization of fraud: As Belcher’s account balance ballooned, attempts to withdraw his funds unveiled the scam’s true nature. He was instructed to reinvest 50% of his balance to access his earnings, prompting suspicion and concern.

Seeking legal aid: Despite encountering skepticism from his bank, Belcher turned to Refundaroo for assistance. Refundaroo’s unwavering dedication and expertise in navigating the complexities of financial fraud empowered Belcher to take decisive action against the perpetrators of the scam. With their comprehensive investigation and legal support, Refundaroo not only provided Belcher with a glimmer of hope but also paved the way for the recovery of his hard-earned money.

Legal intervention and recovery: Refundaroo meticulously examined Belcher’s case, revealing the bank’s negligence in preventing the scam. Despite encountering initial skepticism from the bank, Refundaroo’s relentless pursuit of justice and legal expertise ultimately led to Belcher successfully reclaiming $7,300 of his lost funds.

Insights and Advice: Claudia Cardoso, co-founder of Refundaroo, emphasized the increasing sophistication of scams and the necessity of legal support for victims. She advocated for stricter regulations on cryptocurrency exchanges and platforms to prevent further financial losses.

Final Thoughts: Belcher’s ordeal underscores the prevalence of scams leveraging celebrity endorsements and the importance of remaining vigilant online. As scams grow in complexity, legal assistance becomes essential in combating fraud and reclaiming lost funds.

In conclusion, Refundaroo’s success in recovering Belcher’s funds serves as a beacon of hope for victims of deception. With diligent legal support, victims can navigate the complexities of financial fraud and emerge victorious against deceitful schemes.

by Refundaroo Support | Mar 9, 2024 | Blog, Forex

The foreign exchange (forex) market, with its promise of high returns and round-the-clock trading opportunities, has become increasingly popular among retail investors. However, its complexity and volatility also make it a fertile ground for scams. At Refundaroo, we’ve seen many individuals fall victim to fraudulent schemes that exploit their aspirations and lack of experience. Understanding how these scams work is crucial to protecting yourself and your investments. Here’s how retail investors are often tricked into forex scams and how you can avoid them.

Common forex scam tactics

- Fake brokers

Scammers set up fake brokerage firms with professional-looking websites and persuasive marketing materials. These brokers often promise high returns with minimal risk, drawing in unsuspecting investors. Once you deposit your money, you may find it nearly impossible to withdraw your funds, with the broker offering endless excuses or disappearing altogether.

- Signal sellers

Signal sellers claim to provide insider tips or algorithm-generated signals that guarantee profitable trades. They often charge hefty fees for their services. However, their signals are usually worthless or manipulated to show favorable outcomes in hindsight. Investors who follow these signals often end up losing money.

- Ponzi schemes

In a forex Ponzi scheme, scammers promise high, consistent returns and use new investors’ money to pay returns to earlier investors. This creates an illusion of a successful investment. However, once new investments dry up, the scheme collapses, leaving most investors with significant losses.

- Phishing and identity theft

Scammers use phishing emails and fake websites to trick investors into revealing their personal and financial information. This information is then used to steal funds directly from the investors’ accounts or to commit identity theft.

- Unregulated trading platforms

Some scammers operate through unregulated trading platforms that are not subject to oversight by financial authorities. These platforms may manipulate trading results, refuse withdrawal requests, or disappear with investors’ funds.

Forex scams are a serious threat to retail investors, but with vigilance and the right knowledge, you can protect yourself. If you’ve already been scammed, Refundaroo is committed to helping you recover your funds and regain your financial security. Stay informed, stay cautious, and trust Refundaroo to stand by your side in the fight against financial fraud.