by Refundaroo Support | Aug 11, 2024 | Advice, Announcement, Property

Image used by one of the fake Facebook pages we found posing as real estate agents. Stay cautious and verify all property listings

Property scams have become increasingly sophisticated, targeting unsuspecting buyers, renters, and investors. These fraudulent schemes can lead to significant financial losses and legal complications. Here’s a comprehensive guide to understanding property scams and how to safeguard yourself.

Types of Property Scams

1. Rental Scams

- Phantom Rentals: Scammers list properties that aren’t actually available for rent. They collect deposits or first-month rent from victims before disappearing.

- Fake Landlords: Fraudsters impersonate landlords to trick prospective tenants into paying deposits or rent for properties they don’t own.

2. Purchase Scams

- Fake Property Listings: Scammers create fake property listings with attractive prices to lure buyers. They may ask for a down payment or deposit, then vanish once the money is transferred.

- Title Fraud: Criminals forge documents to sell properties they don’t own. Buyers end up paying for properties that they can’t legally claim.

3. Investment Scams

- Phantom Investments: Fraudsters promote high-return investment opportunities in real estate that don’t exist. Victims are promised large returns on investments that never materialize.

- Misleading Developments: Scammers market non-existent or poorly planned real estate developments, convincing investors to put money into projects that will never be completed.

Red Flags to Watch For

1. Too Good to Be True Deals: If a property deal seems unusually cheap or offers returns that sound too good to be true, it might be a scam. Always research comparable properties and market rates.

2. Pressure Tactics: Scammers often create a sense of urgency, pressuring you to make quick decisions or pay deposits immediately. Take your time to thoroughly vet any property or investment opportunity.

3. Unverifiable Information: Be cautious if the seller or landlord is unwilling to provide verifiable information, such as property ownership documents, or if they avoid in-person meetings or property viewings.

4. Unprofessional Communication: Poor grammar, vague details, and unprofessional communication can be signs of a scam. Legitimate property listings and transactions are typically handled with professionalism and transparency.

How to Protect Yourself

1. Verify Property Listings: Use trusted real estate websites and consult with licensed real estate agents. Verify the legitimacy of property listings and ensure the contact information matches that of reputable agencies.

2. Conduct Due Diligence: For purchases, conduct a thorough background check on the property and seller. Verify ownership through land registry records and consult with a legal professional to review any documents.

3. Avoid Unsecure Payment Methods: Avoid paying deposits or rent through unconventional methods, such as wire transfers to unknown accounts. Use secure payment channels and obtain receipts for all transactions.

4. Visit the Property: Always visit the property in person before making any payments. This allows you to verify its condition and meet with the landlord or seller directly.

5. Consult Professionals: Engage with real estate professionals, including lawyers and real estate agents, who can provide expert advice and help identify potential scams.

6. Report Suspicious Activity: If you encounter a suspected scam, report it to local authorities, the relevant real estate board, or consumer protection agencies. Early reporting can help prevent others from falling victim.

Conclusion

Property scams can have devastating financial impacts, but by staying informed and vigilant, you can protect yourself from these fraudulent schemes. Always verify property details, avoid rushing into decisions, and consult with professionals to ensure your real estate transactions are legitimate. Safeguarding your investments and personal information is crucial in navigating the property market safely.

by Refundaroo Support | Jun 28, 2024 | Advice, Blog, Other scams

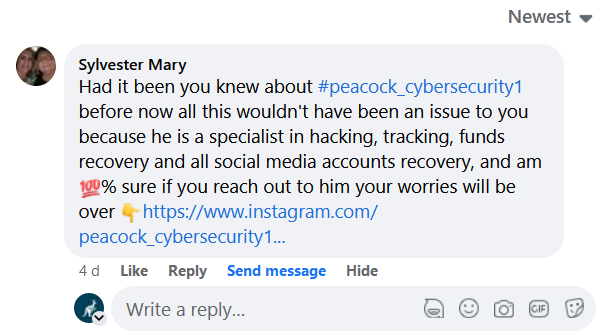

An example of scammer you might see on Facebook

In the interconnected world of social media, staying vigilant against online scams is crucial to safeguarding your personal and financial information. Recently, Refundaroo has observed a troubling trend on Facebook: individuals posing as “hackers for hire,” exploiting unsuspecting users with promises of recovering lost funds or hacking into accounts for a fee. Here’s how you can identify and steer clear of these deceptive schemes:

- Unsolicited Offers: Refrain from engaging with unsolicited messages or friend requests from individuals claiming to offer hacking services. Legitimate professionals typically do not initiate contact in such a manner.

- Too Good to Be True Claims: Exercise caution if an offer guarantees the recovery of lost funds or claims to hack any account for a nominal fee. Legitimate hackers do not make unrealistic promises or engage in illegal activities.

- Verification of Credentials: Genuine hackers often have verifiable credentials, portfolios, or affiliations with reputable organizations. Scammers, on the other hand, lack credible evidence of their expertise.

- Upfront Payments: Be wary of hackers who insist on upfront payments, especially through untraceable methods like gift cards or cryptocurrency. Reputable professionals outline terms and conditions and use secure payment methods.

- Pressure Tactics: Scammers may create a sense of urgency or offer limited-time deals to pressure you into immediate action. Legitimate service providers allow you time to assess their legitimacy and services.

- Communication Quality: Pay attention to the quality of communication. Scammers often exhibit poor grammar, spelling errors, or inconsistencies in their messages—a telltale sign of potential fraudulent activity.

- Realistic Expectations: Understand that it is unrealistic for any hacker to guarantee the recovery of lost funds or engage in activities that defy legal and ethical boundaries. Exercise skepticism toward claims that seem too good to be true.

In conclusion, while the internet presents numerous opportunities, it also poses risks from scammers seeking to exploit vulnerabilities. Protect yourself by verifying credentials, maintaining skepticism, and refraining from engaging with individuals offering dubious hacking services. Remember, legitimate professionals adhere to ethical standards and do not participate in illegal activities. By staying informed and vigilant, you can safeguard your personal and financial security in the digital era. Refundaroo urges all users to stay cautious and report suspicious activities to help create a safer online community for everyone.

by Refundaroo Support | Jun 18, 2024 | Advice, Announcement

Refundaroo understands that your wine collection is not just a hobby—it’s a passion and a significant investment. If your funds are currently tied up with another company, don’t let your prized assets sit idle any longer!

Imagine This Scenario:

You’re at a dinner party, and you realize that the perfect bottle to complement your evening is part of the collection that’s currently stuck. Why wait to enjoy what’s rightfully yours?

Here’s the secret: Wine tastes best when it’s in your cellar, not someone else’s vault.

Take Action Today!

Step 1: Contact Our Recovery Experts

At Refundaroo, our commitment to excellence in financial recovery sets us apart in the industry. When you engage our services, our first priority is a meticulous investigation into the precise location of your investment, be it wine collections or funds held by another entity. Leveraging our extensive network and expertise in financial practices, we uncover the details crucial to your case. This thorough approach ensures transparency and empowers you with clear, timely updates on the status and whereabouts of your assets.

Step 2: Secure Your Collection

Once we locate your collection, our expertise extends beyond recovery. We leverage our established connections within the industry to ensure your wine is sold for its true value. Whether through direct negotiation with buyers or utilizing trusted sales channels, we prioritize maximizing the return on your investment. This meticulous process not only secures your financial assets but also optimizes the outcome, allowing you to reap the full benefits of your initial investment. Our track record speaks for itself, as we continue to deliver tailored solutions that uphold the highest standards of professionalism and integrity in every recovery endeavor.

Step 3: Celebrate Your Success

Once we’ve recovered your funds, it’s time to celebrate! Pop open a bottle and toast to taking control of your investment. After all, wine is meant to be enjoyed, not left in limbo.

Why Refundaroo?

Proven Success: We have a track record of successfully recovering funds for clients in the wine industry.

Expert Team: Our specialists know the ins and outs of financial recovery and are dedicated to getting your investment back.

Hassle-Free Process: We handle everything, so you can focus on what you love—enjoying your wine.

Don’t let your investment gather dust. Reach out to Refundaroo today and start the process of reclaiming what’s yours.

Contact us now and let’s get your collection back where it belongs!

by Refundaroo Support | Jun 17, 2024 | Announcement, Other scams

Attention Refundaroo Users: Beware of Facebook Scams!

Hello Refundaroo Family,

We wanted to alert you to a new scam that’s been targeting businesses on Facebook. Scammers are leaving comments on ads, falsely claiming that you’ve violated Facebook’s terms of service and need to contact them immediately. Please remember, Facebook will always contact you directly about any violations, never through comments on your ads.

What to Watch Out For

Scammers are getting clever, and their tactics can be convincing. Here’s what they’re doing:

- Leaving Comments: Scammers post comments on your business ads, saying you’ve breached Facebook’s policies.

- Creating Urgency: They try to make you panic by suggesting immediate action is needed to avoid serious consequences.

- Phishing for Information: They’ll ask you to contact them through a link or email, trying to steal your personal information.

Real Examples

Here are a few examples of what these scam comments might look like:

- “⚠️ Your account has been flagged for violating Facebook’s advertising policies. Immediate action required! Contact us to resolve this issue.”

- “🚨 Urgent: Your recent ad is in breach of Facebook’s terms of service. Failure to act will result in account suspension. Click the link to contact support.”

How Refundaroo Helps You Recover Lost Funds

If you fall victim to one of these scams and lose money, Refundaroo is here to help. Here’s what we do:

- Immediate Support: Contact our support team as soon as you realize you’ve been scammed. We’re available 24/7 to assist you.

- Investigation: We’ll launch a thorough investigation to understand the scam and gather all necessary details.

- Liaison with Banks: We work directly with your bank and any relevant financial institutions to dispute fraudulent charges and recover your funds.

- Preventive Measures: We’ll help you implement security measures to prevent future scams, including educating your team and setting up alerts.

Protect Yourself

Here’s how you can stay safe:

- Know Facebook’s Communication Methods: Facebook will never contact you via comments. Always check your official Facebook notifications or emails.

- Verify Claims: If you see a suspicious comment, don’t click on any links. Go to your Facebook Business Manager to check for official notifications.

- Report Scammers: Use Facebook’s reporting tools to mark these comments as spam or phishing.

- Stay Informed: Educate your team about these scams and make sure they know how to handle suspicious activity.

Conclusion

Your safety is our priority. By staying informed and vigilant, you can protect your business from these scammers. If you ever need help or suspect you’ve been scammed, Refundaroo is here to support you every step of the way.

Stay safe and secure,

The Refundaroo Support Team

by Refundaroo Support | Jun 9, 2024 | Blog, Cryptocurrency

Matthew reached out to Refundaroo after falling victim to a Bitcoin investment scam through a cloned trading platform.

Like many fraud victims, Matthew (name changed to protect his anonymity) accessed a website he had used many times before and trusted for high-value investments. Unfortunately, the site was a deceptive front. Scammers had cloned the platform, creating a perfect facade to mislead unsuspecting visitors.

Commenting on the ordeal, he said: “People are losing all their money, including life savings, pensions, and inheritance to cloned firms. Sadly, if there is money to be made, someone will do it.”

In Matthew’s case, he decided to invest £25,000 in Bitcoin, something he’d done previously. However, he was left stunned when he was contacted by the Financial Conduct Authority (FCA), who informed him that the company he’d invested in had cloned a regulated firm’s website to commit fraud.

Getting Your Money Back After an Investment Scam

Matthew initially tried to recover his money directly from his bank but was disappointed when they only refunded half of the amount. He said: “My investment was made by bank transfer. Like most banks, they initially refused to accept any liability for my loss, which I didn’t accept, so I wasn’t happy with the outcome.”

Banks have a duty of care to ensure that their clients are protected from unusual activity like this and should be alerted by the fact that Matthew did not have a history of making high-value payments to this particular account.

Reflecting on the process, Matthew commented, “Looking around the internet, I found Refundaroo, who said they dealt with scams and fraud. I had nothing to lose, so I gave them a ring. They told me my bank had to protect my money and recovered all of it. They were very helpful, efficient, and understanding, and I know my money would not have been recovered without their help.”

Claudia Cardoso, co-founder of Refundaroo, said this experience is not uncommon, “Many people feel distraught when they realize they have been tricked out of their savings, but that is why it is so important to get help. We always ask people to notify their bank in the first instance, and if they’re not happy and would like further support, then we can help.”

With Refundaroo’s help, Matthew was able to recover the remaining £12,500 plus interest. Upon getting a refund for the fraud from his bank with the help of Refundaroo, Matthew commented, “I can’t recommend Refundaroo enough. If you are a victim of this type of fraud, then give Refundaroo a call. You have nothing to lose, but you could recover what you have lost.”

Refundaroo can also claim damages for distress and interest (from the date the money was lost), meaning victims get close to, or in some circumstances, more money than they lost.

Refundaroo: Committed to Helping Victims of Cryptocurrency Fraud

Refundaroo is dedicated to assisting victims of cryptocurrency fraud. If you have been affected, find out if you have a case.